Kostelanetz LLP has a long history of helping the underserved through pro bono legal work. COVID-19’s devastating impact has further solidified that commitment. Our attorneys provide pro bono representation in a wide variety of practice areas.

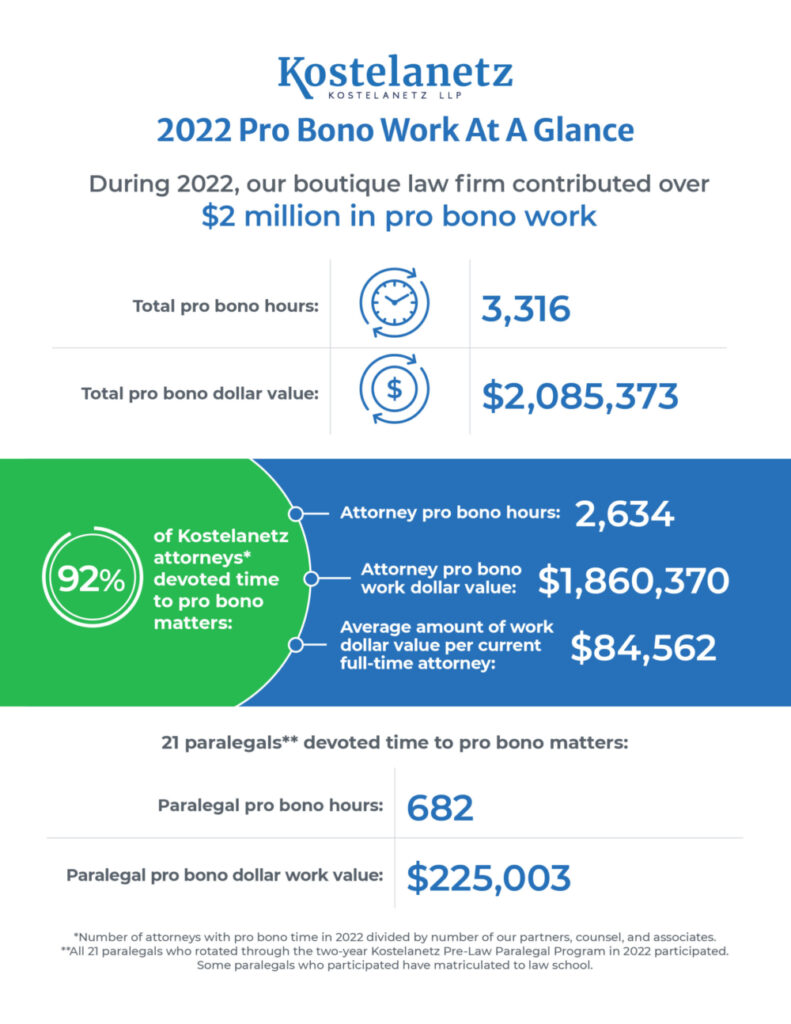

Kostelanetz LLP has a deep-rooted history of helping the underserved through pro bono legal work. We’re proud to say that, during 2022, our boutique law firm contributed over $2 million in pro bono work. Represent indigent taxpayers in tax controversies with the IRS through: Represent individual in Maryland Tax Court challenging on due process grounds the State of Maryland’s refusal to recognize the foreign earned income exclusion in calculating adjusted gross income subject to state tax. Represent individual taxpayer facing federal and state tax collection efforts for withdrawing funds from her retirement fund to improve her residence. Served as expert witness at NYS Tax Appeals Tribunal hearing. Provide pro bono legal services to support the Volunteer Income Tax Assistance (VITA) program, which offers free tax help to people with low incomes, people with disabilities, the elderly and limited English speaking taxpayers who need assistance in preparing their own tax returns. Through the National Association of Criminal Defense Lawyers and New York Federal Defenders, seeking compassionate release in the District of Nebraska and the Southern District of New York for prison inmates facing COVID-19 risks. Joined forces in July 2020 with other law firms across the country to combat systemic racism as part of the new Law Firm Anti-Racism Alliance (LFAA), which will provide pro bono counsel in concert with legal services organizations and other stakeholders focused on identifying and combating systemic racism. More information here. Kostelanetz LLP joined with 49 other law firm leaders in 2022 to lobby for a Clean Slate law in New York. The New York state legislature passed the law in 2023. The law was designed to automatically clear the minor criminal records of millions of New Yorkers who faced lasting barriers to employment, housing, and education because of their criminal records. By clearing those records automatically after a certain period of time, New Yorkers who have been convicted of minor offenses no longer have to engage in costly, time-consuming, and complex court petitions for record clearance. Working, through the Safe Passage Project, to obtain asylum for an 18-year-old who escaped gang violence in El Salvador. Serving as court-appointed counsel in a federal bank fraud case in the SDNY. Representing sex-trafficking victim in a federal criminal investigation. Representing owner of gas stations/self-serve car washes charged with violating Maryland COVID-19 shut down order. Client, a minority business owner, is one of only two people charged in the county. Assisting Public Agenda, a nonprofit organization that strives to strengthen democracy in the United States through nonpartisan research and public engagement, through their efforts to give a democratic voice to communities across the country, as well as engage diverse constituents in their work, including government agencies. Claude Millman serves on Public Agenda’s board of directors. Providing general legal advice to Campus Compact, a not-for-profit organization that seeks to advance the public purposes of over 1,000 colleges and universities by deepening their ability to improve community life and to educate students for civic and social responsibility. Successfully defended a synagogue’s receipt of a zoning variance to support its construction of an annex to promote its religious and not-for-profit mission. Representing the Human Services Council of New York (HSC) in a lawsuit against the City of New York. HSC has 170 members, nonprofit organizations that receive City funding. HSC is challenging New York City Local Law 87 of 2021, a labor relations law that undermines the City’s critical social services safety net. HSC’s principal claim is that the law is preempted by federal labor law. In response to the court’s concerns about whether HSC has standing to challenge the law, we filed an amended complaint containing additional allegations regarding HSC’s interest in the matter, and adding ten plaintiffs, nine of which are HSC members. The action is pending in federal district court in Manhattan. Submitted an amicus brief to New York’s highest court on behalf of the New York Council of Defense Lawyers (NYCDL). The Court endorsed the NYCDL’s position that a juror’s serious misconduct (including sending and receiving numerous text messages during deliberations, and then lying about it) entitled the defendant to a new trial. Submitted an amicus brief for the American College of Tax Counsel (ACTC) to the Court of Appeals for the Ninth Circuit on the question whether the Bank Secrecy Act subjects a U.S. person to a single $10,000 penalty for the non-willful failure to file an annual Report of Foreign Bank and Financial Accounts (“FBAR) (the per-form approach), or imposes separate $10,000 non-willful penalties for each account that was not reported on the FBAR (the per-account approach). The Court adopted the per-form approach advocated by the ACTC, and cited the ACTC brief. Submitted an amicus brief to New York’s highest court for various friends of the court supporting the New York City Taxi and Limousine Commission’s “Taxi of Tomorrow” rules. The Court unanimously agreed with the position we presented. Submitted an amicus brief to the United States Supreme Court on behalf of the American College of Tax Counsel (ACTC) in a case that involved the same issue as the earlier Ninth Circuit case. The ACTC supported the petitioner’s request that the Supreme Court reverse a decision by the Court of Appeals for the Fifth Circuit that adopted the per-account approach and applied multiple penalties per year for the non-willful failure to report separate accounts on an FBAR. The ACTC’s brief explained how the IRS had taken inconsistent positions on this issue over the years in its publications and administrative guidance, and argued that U.S. persons are entitled to clear, unambiguous, and reasonable interpretations of penalty statutes. The ACTC demonstrated how the per-account approach could result in non-willful penalties that grossly exceed the penalties for taxpayers who willfully and intentionally violate their duty to file an accurate FBAR. The Supreme Court agreed with the ACTC’s position, ruled that the per-form approach applies, and cited the ACTC’s brief. A Kostelanetz partner serves on the Advisory Board to the Archdiocese of New York, reviewing claims of clergy sexual abuse of minors and advising the Cardinal in his assessment of such claims. Pro Bono: Kostelanetz Cares