FYERS REVIEW

Overview

Fyers Securities, a Bangalore-based discount stock broker provides trading in equity cash, F&O and currency derivatives segments of the National Stock Exchange. The company’s name is an acronym of ‘Focus Your Energy & Reform the Self’, which represents its year’s core values.

The company is founded by young entrepreneurs, who believe in building the best trading platforms and keeping the cost of trading at its lowest in India.

Fyers is an affordable stockbroker platform in India. They offer the same low brokerage rate across all segments, with a flat ₹20 per executed order fee. No matter how big your order is- Fyers charge you only ₹20 for every transaction! In this case, they also don’t charge any brokerage fees on equity delivery transactions (stocks).

Fyers provides an in-house build web fyers trading platform, installable desktop trading terminal and mobile app to its customers at no cost.

Thematic Investing At Fyers

The advantage of thematic investing is that it allows you to invest in a group of stocks related to an idea, instead of having to choose individual stocks. Fyers offers 100s predefined themes (or portfolios) which customers can choose from and use for their investment needs. Each theme has a set each one with a different set of stock that relates specifically to the idea.

The closest comparison for thematic investments is Exchange Traded Funds (ETFs). Thematically investing broker in a theme means the fund manager or even a group of people can identify companies to invest in. This offers more flexibility over ETFs where you are limited by which company invests.

How does thematic investing work

- The fyers broking has a set of themes that represent ideas such as I want to invest in industries in Gujrat.

- The broker has identified a list of companies matching the theme, which includes a number of stocks.

- Investors generally choose a theme and then invest in it.

- The broker invests the money in each individual stock that is a part of the theme within the proposition.

Fyers Account Opening Charges

Opening an account with Fyers is free if you choose to open it online. If you would like to do so offline, then the charge will be Rs 400. Demat charges are Rs 300 per year.

Transaction | Charges |

Trading & Demat account opening | ₹ 0 |

Trading account AMC | ₹ 0 |

Demat account AMC (Free for 1st year) | ₹ 300 per year (from the second year) |

Fyers Brokerage Account Charges

Fyers follows a fixed brokerage model– it charges Rs 20 or 0.03%, whichever is lower, per executed order. It also charges zero commission trading on equity delivery and the maximum chargeable brokerage per order is Rs 20.

Segments | Brokerage Fees |

Equity delivery | Free |

Equity intraday | ₹ 20 per executed order of 0.03% whichever is lower |

Futures (Commodity, Currency &Equity) | ₹ 20 per executed order of 0.03% whichever is lower |

Options (Commodity, Currency &Equity) | ₹ 20 per executed order |

Fyers Equity Brokerage Charges Explained

Fyers Charges | Equity Intraday | Equity Delivery |

Brokerage account | ₹ 20 per executed order of 0.03% whichever is lower | Free |

STT | 0.025% on the sell-side | 0.1% on both buy & sell |

Transaction / Turnover charges | NSE: 0.00325% | NSE: 0.00325% |

GST (Goods and services tax) | 18% on Brokerage & Transaction charges | 18% on Brokerage & Transaction charges |

SEBI charges | 0.0001% (₹10/crore) | 0.0001% (₹10/crore) |

Stamp duty | 0.003% (₹300 per crore) on buy-side | 0.015% (₹1500 per crore) on the buy-side |

Fyers F&O Brokerage Charge Explained

Fyers Charges | Options | Futures |

Brokerage | ₹ 20 per executed order | ₹ 20 per executed order of 0.03% whichever is lower |

STT | 0.05% on the sell-side (on premium) | 0.1% on both buy & sell |

Transaction / Turnover charges | NSE: 0.053% | NSE: 0.021% |

GST (Goods and services tax) | 18% on Brokerage & Transaction charges | 18% on Brokerage & Transaction charges |

SEBI charges | 0.0001% (₹10/crore) | 0.0001% (₹10/crore) |

Stamp duty | 0.003% (₹300 per crore) on buy-side | 0.002% (₹200 per crore) on buy-side |

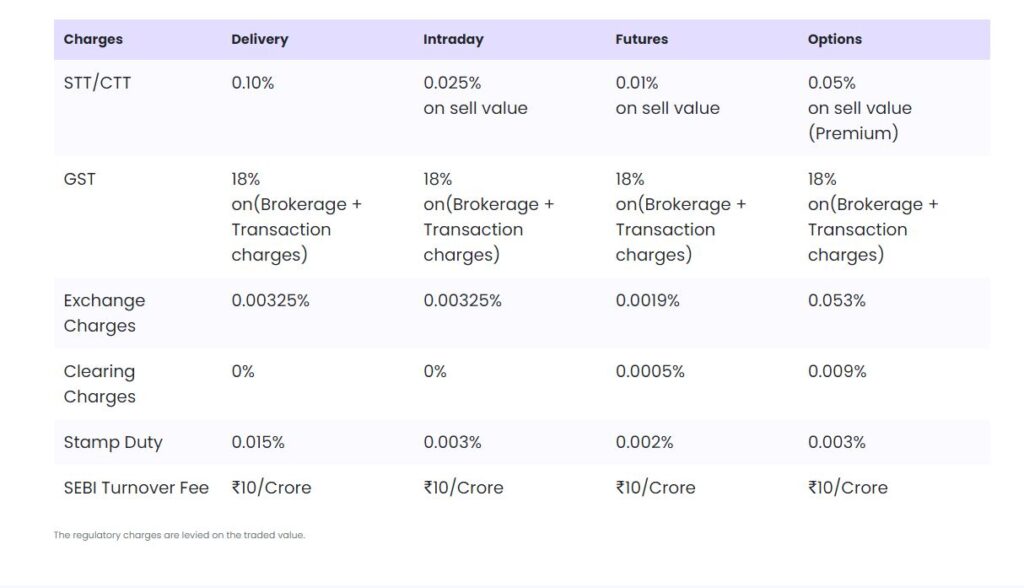

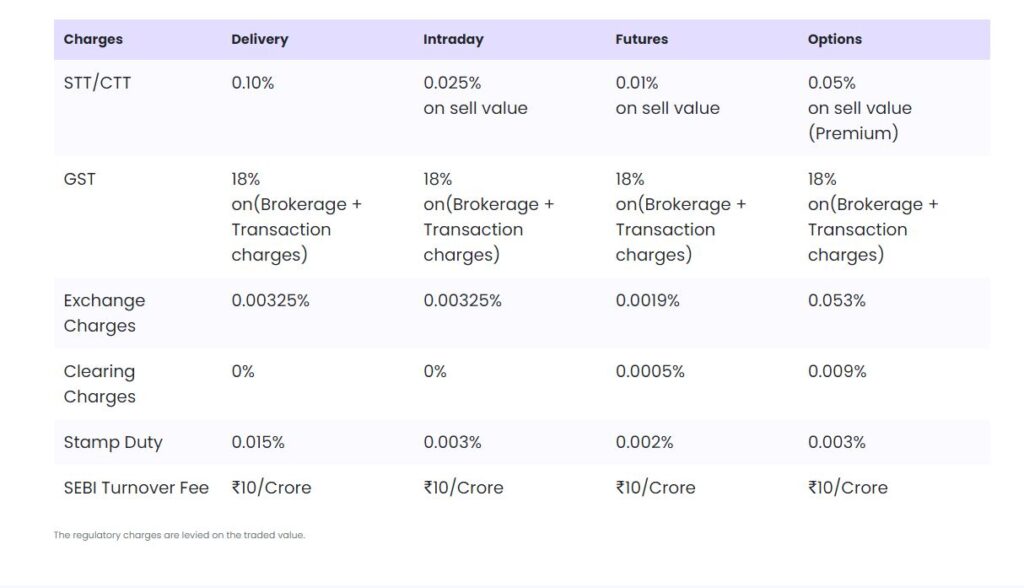

Fyers Fee Structured Explained

Securities and transaction tax – The Securities Transaction Tax (STT) is only charged on the sell side of a transaction for intraday and F&O trades. It is also charged on both sides when brokerage trading Delivery stocks, like equities.

GST (Goods & Services Tax) – This will be charged at 18% of the total cost, including brokerage and transaction fees.

SEBI Charges – The SEBI Charges are Rs 10 per Crore.

Stamp Duty – Equity Delivery – 0.015% (buy-side), Equity Intraday – 0.03% (buy-side).

Fyers Other Charges

Transaction charges | 0.00275% of total turnover |

SEBI turnover charges | 0.0002% of total turnover |

STT | 0.0126% of total turnover |

GST | 18% on Brokerage & Transaction charges |

Stamp duty | Depends on the state (Very minimal) |

There are additional fees that will be charged in accordance with the fyers pricing and the policy. These fees will be listed below:

- For every executed trading order, there is a transaction charge of 00275% of the total turnover charges.

- The securities transaction charge is 1.26%.

- Valid taxes levied by the state government depend on where you trade. Stamp duty at the state level will be charged as applicable.

- The SEBI fees will be charged 0.002% of total turnover.

- GST on trading is 18% of the total brokerage and transaction charge.

Fyers Other Charges

Pledge Charges – If you are interested in availing of this service, the current charge is Rs. 50 + Rs. 12 per security (CDSL charges) for pledge or unpledged requests and a fee of Rs 50 to submit a pledge invocation request.

Dematerialization – In order to avail of this service, in particular, you will be charged Rs 100 per certificate.

Rematerialization – There is also an additional charge for converting electronic certificates into physical form, which is Rs 100 per certificate + CDSL charges.

Fyers Margin Exposure Or Leverage

Equity intraday | up to 16x based on the stock |

Equity futures | Intraday: 4 times Carry forward: 100% of Total margin (Span+Exposure) |

Equity delivery | Upto 1x |

Equity options | Sell at 4x intraday, buy with 1.3x CO, buy without CO and hold one day only, carry forward as normal. |

Currency futures | Intraday – 40% (2.5x), Carry forward – 100% of Total margin (Span+Exposure) |

Currency options | Intraday – 40% (2.5x), Carry forward – 100% (1x) of Total margin (Span+Exposure) (Options selling). |

Commodities | NA |

Margin Calculator | – |

The market exposure is the value of money or ratio of investment, which will be invested to trade a certain segment (market) or commodity. The market exposure is often presented as a proportion of total portfolio stocks.

- Taking leverage from a broker can give you a large return, but also make it happen that if the position faces loss you will get huge losses. It is always advised to not take exposure when you trade.

- Fyers offers a maximum of 16 times exposure on intraday trades.

- For trading in Derivative Equity futures, different levels of exposure are provided depending on the type of order.

- Trading in equity derivatives through options provides up to four times the exposure of intraday trades.

- Up to 40% (2.5x) of the intraday currency trading is given in the future and option trading for maximum time duration.

Fyers Products & Services

The list of products and services provided by the company to its clients

Fyers Securities Product

Commodity trading | Yes |

Currency trading | Yes |

Equity trading | Yes |

Futures | Yes |

Options | Yes |

Forex | No |

Mutual funds | Yes |

SIP | Yes |

Insurance | No |

Banking | No |

Fyers brokers provide a wide range of financial products to customers, so they can trade.

- The Trader can trade in equity on an intraday and delivery basis.

- They offer a platform for trading commodity stocks on the MCX and NCDEX.

- With Fyers security, you can trade currencies.

- Trading in derivative equity can be performed through options and futures.

- They provide opportunities to invest in important financial instruments such as SIPs and mutual funds.

- Fyers provides an innovative tool for calculating margins and brokerages for trading in all different segments of the security market.

Fyers Securities Services

Trading Services | Yes |

Demat Services | Yes |

Intraday services | Yes |

3 in 1 account | No |

IPO services | Yes |

PMS | No |

Robo advisory | No |

Stock recommendations | No |

Trading institution | No |

Trading exposure | Yes |

Fyers is a financial institution that provides services to customers. They provide traders with all of the necessary tools for their Demat account,

- Trading Services help you trade in the financial markets: National Stock Exchange, Bombay Stock Exchange and Commodity.

- They offer services based on intraday trading if the stock is square off on that day.

- Trading and reports based on IPO are available.

- They offer the maximum exposure to their customers with up to 16times to their customers.

Fyers Trading Software

The trading platform at Fyers is one of a kind because it was developed in-house, and includes the front-end as well as the backend (including the risk management engine and order management system). The trading platform is still evolving, and tons of new features are being added each month.

The Fyers trading platform has three major applications:

Fyers One (Desktop Trading terminal)

Fyers stocks are built for professional traders, loaded with industry-standard features. These include advanced charting, flexible workspaces, F&O analysis tools and stock screeners. In addition to this, we have an advanced end-of-day reporting system as well as a portfolio tracker.

- Multiple segments and exchanges are available to access.

- Create watch lists that are set by the sector, index, or derivative

- Historical EOD data of 10+ years and intraday data for 30 days (1 minute and 5 minutes) are available with advanced charting facilities.

- 60+ technical indicators

- The inbuilt technical stock screeners monitor intraday movements, circuit breakers, support and resistance levels – all you have to do is enter your criteria!

- Heat maps and Index meters are two of the most popular tools for reading the pulse of the industry.

- It provides real-time information and announcements on key events of companies.

Fyers Market (Mobile Trading App)

Fyers Markets is a rich mobile trading app for Android and iOS devices which has plenty of features. Key features include stock screening, live quotes at the touch of your fingertips and preloaded options strategies with technical indicators. You can also transfer funds to & from Fyers through this advanced app on your phone or tablet.

- Trade on various stock exchanges, including NSE and BSE.

- 20+ years of historical data for EOD and 9+ months of historical intraday charts

- Analytics tools are built-in features for critical insights into the market.

- 65+ Technical Indicators and Other Tools

- Stock screeners are tools that allow you to find stocks from specific sectors and indices.

- 43+ Strategies to Learn, Simulate and Execute

- Live updates from the exchanges and markets.

Fyers Web Trader

For Investors and traders who are comfortable with trading through a website, the Fyers Web Trader is an online application. The Fyers Web Trader can be accessed from any web browser, which offers features such as portfolio tracking and auto-screened option strategies (multi-leg orders). It also comes with a live data feed.

- Trade-in multiple instruments across the NSE and BSE.

- Advanced Charting with Historical End of Day Data of 20+ Years

- This app has over 70 indicators, 300 interactive icons and several drawing tools.

- Price ladder trading is an excellent option for intraday traders.

- You can place, modify, and cancel orders directly from the chart.

- View and monitor open positions, orders, and transactions

Fyers Advantages & Disadvantages

ADVANTAGES OF FYERS SECURITIES

When you read the advantages and disadvantages of Fyers, you can decide if it suits your needs as an investor. The pros and cons will help determine this.

- No cost for online account opening.

- Get free equity delivery trading with no brokerage when you trade cash & carry.

- Get the best brokerage rates with Fyers, which charges flat Rs 20 per trade. You’ll get a discount broker without paying any extra charges for your trades.

- There are no hidden charges, and our fees/charges are very transparent.

- An in-house build trading platform offers the flexibility to quickly implement new features or services.

- All trading software is available for free.

- Single margin account

- Refer your friends and earn 20% of their future income, for life!

- Demat account, no power of attorney.

DISADVANTAGES OF FYERS SECURITIES

The following are the disadvantages of Fyers.

- Exchange transaction fees are higher than other brokers.

- They do not have an analytics team that can provide market analysis.

- Commodity trading cannot be performed with Fyers.

Fyers Review: Final Thought

FYERS proves its innovative name because of the excellent job performed by young finance business owners.

You will only be registered at NSE and this means you have less chance to expand your portfolio. As can be seen by being a newcomer in online stock trading, FYERS offers services at extremely nominal costs. We also advise you to go there after mentioning the disadvantage of being a newcomer here.

They offer a free, intelligent online platform that is fresh and technical. Also, it has relatively inexpensive costs.

The graphics and other functionalities of this terminal are not that different from others, but when it comes to stock testing, they’re much better. That is why they were awarded the best stock screener application in 2018.

Fyers offers a 100% free trading platform. You just have to open a Fyers account and make trades by depositing funds or using the margin & leverage available! The opening of your account is also FREE.