Buying your first property is a significant milestone. For first-time property buyers in Malaysia, the journey can be both exciting and overwhelming. Navigating the complexities of the Malaysian real estate market requires preparation, research, and careful decision-making.

This guide provides actionable tips and insights to help you make informed choices and turn your dream of owning a home into reality.

Whether you are looking for an investment or a home to live in, this article will cover everything you need to know.

Understanding the Malaysian Property Market

Malaysia’s property market is diverse, offering a variety of options, from landed homes to high-rise apartments. Urban areas like Kuala Lumpur, Selangor, and Penang are known for their bustling markets, while suburban and rural areas offer more affordable and spacious options. With a mix of freehold and leasehold properties, buyers have options that suit different budgets and preferences.

Key considerations for first-time property buyers in Malaysia:

- Landed Properties: Typically more expensive but offer better privacy and space.

- High-Rise Apartments: Affordable with shared amenities like pools and gyms.

- Suburban vs. Urban: Suburban areas are ideal for families, while urban locations suit professionals seeking convenience.

Types of Properties in Malaysia

| Property Type | Key Features | Ideal For |

| Landed Properties | Private, spacious, long-term value | Families, luxury buyers |

| High-Rise Apartments | Affordable, shared amenities | Young professionals, small families |

| Suburban Properties | Quiet, family-friendly, affordable | First-time buyers, families |

| Urban Properties | Central, convenient, high demand | Investors, professionals |

Key Trends in 2025

The Malaysian property market in 2025 is showing signs of recovery post-pandemic, with affordable housing initiatives and growing interest in suburban developments. Hotspots include areas like Rawang and Cyberjaya, where infrastructure development is attracting buyers. Additionally, the demand for sustainable housing and smart home features is growing, driven by younger buyers seeking tech-enabled living.

Financial Preparation for Property Purchase

Assessing Your Budget

Knowing your budget is the first step. Most first-time property buyers in Malaysia underestimate the costs associated with purchasing a home. It’s not just about the property price but also additional fees, taxes, and maintenance costs.

Tips for budgeting:

- Use a mortgage calculator to estimate monthly repayments.

- Allocate 30-40% of your income for housing expenses.

- Keep an emergency fund for unexpected costs such as repairs or renovations.

Understanding Down Payments and Hidden Costs

In Malaysia, a 10-20% down payment is standard. However, additional costs include legal fees, taxes, and maintenance charges that can significantly increase the overall expenditure. Understanding these upfront helps avoid surprises later.

Estimated Costs for First-Time Buyers

| Cost Component | Percentage/Amount |

| Down Payment | 10%-20% of property price |

| Stamp Duty | 1%-3% |

| Legal Fees | ~1% |

| Maintenance Fees | Monthly, varies by property |

| Valuation Fees | RM500 – RM1,500 |

| Loan Agreement Fee | ~1% of loan amount |

Researching the Right Location

Key Factors to Consider

Location is critical for first-time property buyers in Malaysia. It impacts not just your living experience but also the long-term value of your property. Consider factors such as accessibility, future infrastructure developments, and proximity to essential services.

Key Factors to Look for in a Location:

- Proximity to Work: Short commutes save time and money.

- Access to Amenities: Schools, hospitals, shopping centers, and public transport.

- Growth Potential: Areas with new infrastructure projects often see appreciation in property value.

Location Comparison

| Factor | Urban Areas | Suburban Areas |

| Proximity to Amenities | High | Moderate |

| Traffic and Noise Levels | High | Low |

| Property Prices | Expensive | Affordable |

| Future Development | Moderate | High |

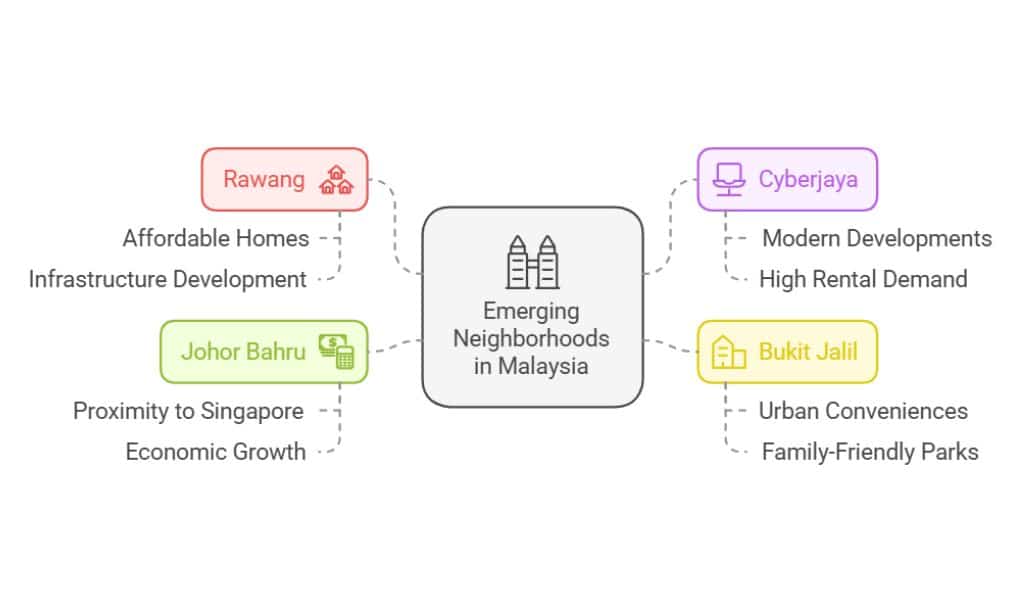

Top Emerging Neighborhoods in Malaysia

- Rawang: Affordable homes with growing infrastructure like new highways and rail links.

- Cyberjaya: A tech hub with modern developments and high rental demand.

- Bukit Jalil: Urban conveniences, excellent connectivity via MRT, and family-friendly parks.

- Johor Bahru: Thriving economy due to proximity to Singapore.

Evaluating Property Types and Developers

Choosing Between New vs. Subsale Properties

For first-time property buyers in Malaysia, deciding between new and subsale properties can be challenging. New properties often come with modern amenities but require waiting for completion. Subsale properties allow immediate occupancy but may involve renovation costs.

New vs. Subsale Properties

| Aspect | New Properties | Subsale Properties |

| Price | Higher | Moderate |

| Waiting Period | 2-5 years | Immediate |

| Condition | Brand new | May need renovation |

| Neighborhood Development | Developing | Established |

Understanding Freehold vs. Leasehold Properties

Freehold properties provide ownership in perpetuity, making them more desirable but often pricier. Leasehold properties are cheaper but come with tenure limitations (usually 99 years).

Freehold vs. Leasehold Properties

| Aspect | Freehold | Leasehold |

| Ownership Duration | Permanent | Limited (usually 99 years) |

| Price | Higher | Lower |

| Renewal Requirements | None | Renewal fee upon expiration |

Navigating Loan Applications

Eligibility Criteria for Housing Loans in Malaysia

Understanding loan eligibility is essential for first-time property buyers in Malaysia. Banks assess factors such as your income, credit score, and Debt Service Ratio (DSR).

Key Requirements:

- Proof of income: Payslips and bank statements.

- DSR below 70%: Ensures affordability.

- Good credit score: Ensures favorable loan terms.

Comparing Interest Rates and Loan Options

To secure the best home loan, compare options from multiple banks. Consider fixed vs. floating interest rates and Islamic financing options, which are Sharia-compliant.

Loan Comparison

| Bank | Interest Rate (Approx.) | Loan Tenure |

| Maybank | 3.1% | Up to 35 years |

| CIMB | 3.2% | Up to 30 years |

| Public Bank | 3.3% | Up to 35 years |

| Islamic Financing | 3.5% (profit-sharing) | Up to 35 years |

Understanding the Legal Process

Role of Real Estate Agents and Lawyers

Hiring professionals simplifies the process and ensures legal compliance. Real estate agents can help find properties and negotiate deals, while lawyers assist with the Sale and Purchase Agreement (SPA) and title transfer.

Key Legal Documents and Procedures

Ensure you have all necessary documents, including:

- Sale and Purchase Agreement (SPA).

- Loan Agreement.

- Title Transfer (for freehold properties).

Legal Fees Breakdown

| Legal Service | Cost Estimate |

| SPA Preparation | ~1% of property price |

| Title Transfer Fee | RM300 – RM500 |

| Loan Agreement Fee | ~1% of loan amount |

Inspecting the Property Before Purchase

Checklist for Property Inspections

Before committing, inspect the property thoroughly. Many first-time property buyers in Malaysia overlook this step and face costly repairs later.

Inspection Checklist:

- Structural Issues: Look for cracks, dampness, or uneven floors.

- Plumbing and Electrical Systems: Check water pressure, wiring, and outlets.

- Age of the Property: Older homes may need more maintenance.

Planning for Post-Purchase Costs

Maintenance Fees and Property Taxes

Strata properties have monthly maintenance fees, which vary based on facilities. Property taxes include quit rent (annual fee for landowners) and assessment tax (paid to local councils).

Budgeting for Renovations and Furnishings

Factor in costs for renovations and furnishings.

For example:

- Renovating a kitchen: RM10,000 – RM30,000.

- Furnishing a bedroom: RM5,000 – RM15,000.

Renovation Costs

| Renovation Type | Cost Range |

| Kitchen | RM10,000 – RM30,000 |

| Bathroom | RM5,000 – RM15,000 |

| Living Room | RM10,000 – RM25,000 |

Common Mistakes to Avoid

Skipping Financial Planning

Without a clear budget, first-time property buyers in Malaysia risk overcommitting and facing financial strain.

Ignoring Market Research

Failing to understand market trends can lead to buying overpriced properties or missing out on growth opportunities.

Takeaway

Buying your first property in Malaysia can be an exciting journey with the right preparation. By understanding the market, budgeting wisely, and seeking professional guidance, first-time property buyers in Malaysia can make confident decisions.

Start your journey today and take the first step toward owning your dream home.