Former Boss of Rank Group a Contender To Take the Reigns at Entain

Entain, the FTSE-100 owner of Ladbrokes and other online gaming operators, is undergoing a significant leadership transition following Jette Nygaard-Andersen’s departure.

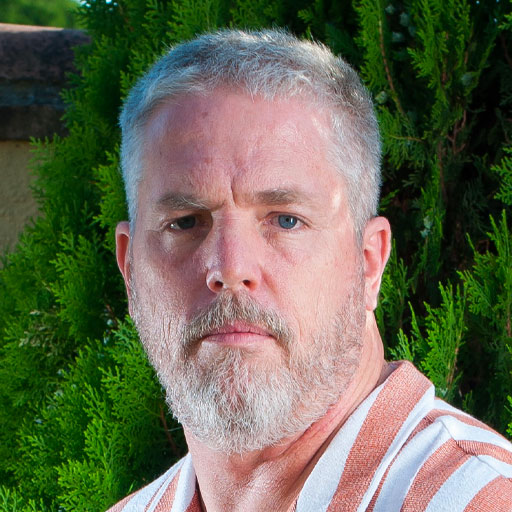

Henry Birch, former CEO of Rank Group, has emerged as a prominent contender for the CEO position. Birch’s extensive leadership experience, coupled with his tenure at Very Group, positions him as a notable candidate to steer Entain through its current challenges.

The company is navigating a tumultuous period marked by internal restructuring and regulatory challenges across global markets. Over the past year, Entain’s stock has experienced a fifty percent decline, with its market capitalization now standing just below £5 billion ($6.92 billion).

Birch’s potential appointment shows Entain’s strategic imperative to appoint a seasoned executive capable of navigating the complexities of the gambling industry amidst regulatory scrutiny. However, sources indicate that other candidates are also under consideration, suggesting a rigorous selection process ahead.

Birch’s professional trajectory includes notable stints within the gambling sector, particularly at Very Group, where he played a pivotal role in achieving annual sales surpassing £2 billion ($2.76 billion). His four-year tenure as CEO of William Hill Online further solidifies his candidacy, offering valuable insights into the intricacies of the multichannel gaming landscape.

Entain’s investor community has emphasized the importance of appointing a CEO with deep-rooted expertise in the gambling industry to address the company’s current challenges.

Despite Birch’s prominence, notable figures within the gambling industry, including former executives from Coral and Skybet, have reportedly declined offers to lead Entain, which shows the company’s challenge in attracting top-tier talent.

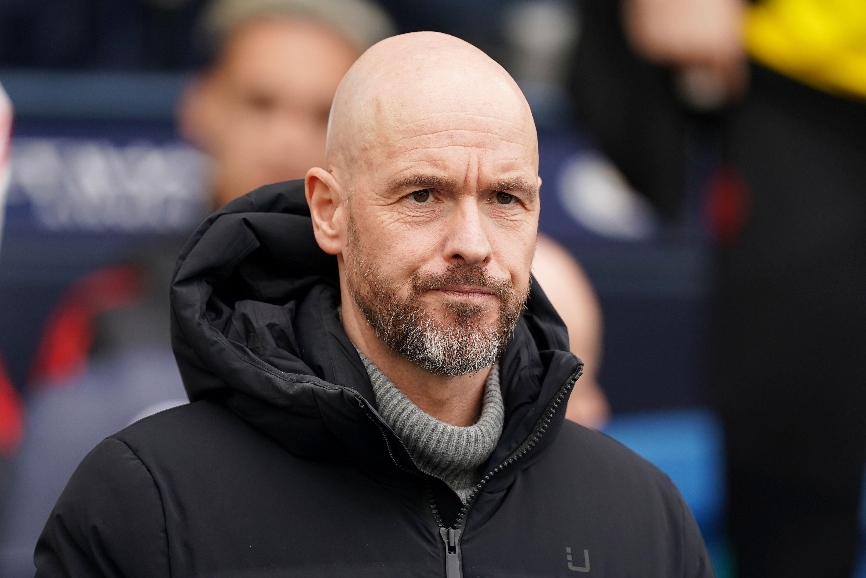

Industry sources suggest that Dan Taylor, the CEO of Flutter Entertainment’s international operations, has also been approached about the CEO position at Entain.

But Taylor’s level of interest remains uncertain.

Entain’s recent engagement with activist investors, including Eminence Capital, proves the mounting pressure on the company’s board to effect strategic leadership changes and restore investor confidence.

Ricky Sandler’s appointment to Entain’s board as a non-executive director in January reflected the company’s proactive stance in addressing investor concerns and enhancing governance practices.

The impending retirement of Barry Gibson, Entain’s Chairman, signals a pivotal leadership transition within the company. Stella David is poised to assume the interim chairmanship role.

Entain’s strategic initiatives, including the divestment of non-core assets such as PartyPoker and potentially BetCity, reflect the company’s commitment to streamlining operations and focusing on core business verticals.

Despite previous acquisition overtures from MGM Resorts in 2021, Entain’s board rebuffed the proposal, citing valuation misalignment. Analysts speculate on the potential resurgence of acquisition interest from MGM Resorts in the future.

Entain’s regulatory woes, including a substantial £615 million (US$777.85 million) penalty for lapses in compliance at its former Turkish subsidiary, have prompted heightened scrutiny of the company’s governance practices and operational integrity.

Entain’s share price closed at 778.8 pence (US$9.85) on Friday, reflecting a market capitalization of £4.98 billion ($6.87 billion). This highlights the company’s enduring market presence despite recent challenges.

- Other news categories:

- SlotsUp's news