0 ratings0% found this document useful (0 votes)

143 viewsMATH3804 Syllabus

MATH3804 Syllabus

Uploaded by

ChakShaniqueThis document summarizes an Actuarial Mathematics II course, which is a compulsory level III course and important foundation for an actuarial science degree. The course expands on topics from Introduction to Actuarial Mathematics, and teaches fundamental mathematical techniques for valuing cash flows dependent on uncertain events like death, survival, and sickness. Students will learn to calculate reserves and premiums for various insurance and annuity contracts using single and multiple decrement tables, construct multiple decrement tables, and perform calculations using Markov chain models. Assessment includes a coursework exam worth 25% and a final exam worth 75%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

MATH3804 Syllabus

MATH3804 Syllabus

Uploaded by

ChakShanique0 ratings0% found this document useful (0 votes)

143 views3 pagesThis document summarizes an Actuarial Mathematics II course, which is a compulsory level III course and important foundation for an actuarial science degree. The course expands on topics from Introduction to Actuarial Mathematics, and teaches fundamental mathematical techniques for valuing cash flows dependent on uncertain events like death, survival, and sickness. Students will learn to calculate reserves and premiums for various insurance and annuity contracts using single and multiple decrement tables, construct multiple decrement tables, and perform calculations using Markov chain models. Assessment includes a coursework exam worth 25% and a final exam worth 75%.

Original Description:

Syllabus for UWI Actuarial Mathematics

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document summarizes an Actuarial Mathematics II course, which is a compulsory level III course and important foundation for an actuarial science degree. The course expands on topics from Introduction to Actuarial Mathematics, and teaches fundamental mathematical techniques for valuing cash flows dependent on uncertain events like death, survival, and sickness. Students will learn to calculate reserves and premiums for various insurance and annuity contracts using single and multiple decrement tables, construct multiple decrement tables, and perform calculations using Markov chain models. Assessment includes a coursework exam worth 25% and a final exam worth 75%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

143 views3 pagesMATH3804 Syllabus

MATH3804 Syllabus

Uploaded by

ChakShaniqueThis document summarizes an Actuarial Mathematics II course, which is a compulsory level III course and important foundation for an actuarial science degree. The course expands on topics from Introduction to Actuarial Mathematics, and teaches fundamental mathematical techniques for valuing cash flows dependent on uncertain events like death, survival, and sickness. Students will learn to calculate reserves and premiums for various insurance and annuity contracts using single and multiple decrement tables, construct multiple decrement tables, and perform calculations using Markov chain models. Assessment includes a coursework exam worth 25% and a final exam worth 75%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

COURSE NAME: ACTUARIAL MATHEMATICS II

COURSE CODE: MATH3804

LEVEL: III

SEMESTER: I

NUMBER OF CREDITS: 3

PREREQUISITES:

Mathematics of Finance (MATH2210), Introduction to Actuarial Mathematics (MATH2220)

RATIONALE

This course is an extension and expansion of that for Introduction to Actuarial Mathematics. The

goal of the syllabus is to provide an understanding of fundamental mathematical techniques

required to value and model cash flows dependent on death, survival, disability, termination,

sickness and other uncertain events. It also covers multiple life and other types of status.

COURSE DESCRIPTION:

This is a compulsory level III course which is an important foundation course in actuarial science.

Candidates should master the fundamental concepts of actuarial and financial mathematics and its simple

applications as indicated in the Learning outcomes. This course allows the candidate to begin

preparation for the professional examinations (the Society of Actuaries Actuarial Models examination,

Exam 3 of the Casualty Actuarial Society, and the Faculty/Institute of Actuaries Contingencies

examination).

LEARNING OUTCOMES

On completion of this course the student should be able to:

Calculate the reserves for life insurance and annuity contracts based on single and

multiple decrement tables using the Prospective and Retrospective Methods.

Calculate premiums for all types of policies based on the multiple decrement tables and

single life table (SDT)

Be able to construct a Multiple Decrement Table (MDT) and its Associated Single

Decrement Tables (ASDT).

Carry out calculations based on both the SDT and the MDT.

Do all types of problems based on joint life, multiple life, last survivor statuses.

Carry out calculations for Reversionary Annuities.

Understand and be able to do calculations using the Common Shock Model.

Understand continuous-time Markov chain models, discrete approximations of

continuous-time Markov chain models and discrete-time Markov chain models

CONTENT

Reserves

Based on Single Decrement (Life) Table: Calculation of Reserves using Prospective and Retrospective

methods, Recursive Formula, Policy Alteration

Joint Life Functions

Study of T(x) and T (y), the complete future lifetimes of two lives (x) and (y), Joint Cumulative

Function, Joint Density Function, Joint survival function, Covariance of T(x) and T (y),

Correlation coefficient of T(x) and T(y), Marginal distributions of T(x) and T(y)

Study of the Joint Status (xy) and Last Survivor

Definition of joint status (x y) and Last Status Survivor xy , Full study of T (x y) including and

T xy , Cumulative Distribution Function, Probability Density Function, Expectation, Variance,

Survival Function, Probabilities associated with T(xy) and T xy , Force of failure of the status

(xy) and status xy

Insurances and Annuities

Problems on Insurances and Annuities based on Joint Life status and Last survivor status,

Problems on Reversionary Annuities

The Common Shock Model

Definitions, Modelling Dependence, Applications to all types of Insurance and Annuity

Problems

MDT and ASDT

Definitions, Complete study of MDT, Complete study of ASDT, Construction of MDT from

ASDT and vice versa, Incorporating continuous and discrete decrements, Problems involving

MDT and ASDT, Applications to Pensions Annuities and Insurances.

Markov Chain Models

Calculate the probability of being in a particular state and transitioning between states based on

continuous-time Markov chain models, discrete approximations of continuous-time Markov

chain models and discrete-time Markov chain models.

Calculate present values of cash flows by redefining the present-value-of-benefits and present-

value-of-premium random variables to Markov chain models.

Calculate benefit reserves and premiums using a Markov chain model with specified cash flows.

TEACHING METHODOLOGY:

This course will be delivered by a combination of theoretical classes, practices (tutorials) and

other group activities. The delivery mode will be largely interactive. The total estimated 39

contact hours are broken down as follows: 28 hours of lectures and 11 hours of tutorials. The

course material (complimentary notes, practice problems and assignments) will be posted on

ourvle http://ourvle.mona.uwi.edu/

ASSESSMENT:

The course assessment will be divided into two components: a coursework component worth

25% and a final exam worth 75%.

One coursework exam worth 25% of the final grade

The final exam will be two hours in length and consist of compulsory questions.

REFERENCE MATERIAL

Prescribed Text:

Bowers, N.L. et al, Actuarial Mathematics (Second Edition), 1997, Society of Actuaries

Highly Recommended Text:

Cunningham, R. Herzog, T., Moels for Quantifying Risk (Thir Edition), 2009, Actex Publications

Online resources:

The following are free online lectures which the student may access for revision purposes:

http://www.soa.org/files/pdf/edu-2008-spring-mlc-24-2nd.pdf

http://www.actuarialseminars.com/Misc/SNorderform.html

You might also like

- Professional Examination PDFDocument35 pagesProfessional Examination PDFDeepak Gupta71% (7)

- ENMG 616: Advanced Optimization Techniques (3 CR.) Course SyllabusDocument4 pagesENMG 616: Advanced Optimization Techniques (3 CR.) Course SyllabusYoumna ShatilaNo ratings yet

- Mathematics As A LanguageDocument25 pagesMathematics As A Languagepijej25153No ratings yet

- Measure of Dispersion (Range Quartile & Mean Deviation)Document55 pagesMeasure of Dispersion (Range Quartile & Mean Deviation)Wasie UrrahmanNo ratings yet

- Learning Competencies:: Lesson 1: Hypothesis TestingDocument45 pagesLearning Competencies:: Lesson 1: Hypothesis TestingChristell Mae LopezNo ratings yet

- LESSON 8 Qualitative and Quantitative ReserachDocument19 pagesLESSON 8 Qualitative and Quantitative ReserachMa. Aiza SantosNo ratings yet

- Mathematics in The Modern World SOURCEDocument8 pagesMathematics in The Modern World SOURCERex Jason FrescoNo ratings yet

- Measure of Position or LocationDocument2 pagesMeasure of Position or LocationMelvin CabonegroNo ratings yet

- CE 211 Module PDFDocument46 pagesCE 211 Module PDFGlorina CurammengNo ratings yet

- BIOSTAT Random Variables & Probability DistributionDocument37 pagesBIOSTAT Random Variables & Probability DistributionAnonymous Xlpj86laNo ratings yet

- Applied Statistics SyllabusDocument7 pagesApplied Statistics SyllabusPaul Dela RosaNo ratings yet

- Syllabus STS New NormalDocument11 pagesSyllabus STS New Normalemmanuel maboloNo ratings yet

- Subjective Data: Baseline Data of Client.: Reference: Nurse's Pocket Guide: Diagnoses, Interventions, and RationalesDocument4 pagesSubjective Data: Baseline Data of Client.: Reference: Nurse's Pocket Guide: Diagnoses, Interventions, and RationalesJor GarciaNo ratings yet

- Week 3 Lec. NCMA110. Overview of Theory in NursingDocument2 pagesWeek 3 Lec. NCMA110. Overview of Theory in NursingMai Dei100% (1)

- Self Learning ModuleDocument95 pagesSelf Learning ModuleJayvee Abrogar100% (1)

- Cmrmiranda Powerpoint Presentation November2011 Macro EconomicsDocument15 pagesCmrmiranda Powerpoint Presentation November2011 Macro EconomicsjameskagomeNo ratings yet

- Statistical Representation of DataDocument118 pagesStatistical Representation of Datayashar2500No ratings yet

- Measures of DispersionDocument13 pagesMeasures of Dispersionsabnira AfrinNo ratings yet

- Measures of Central Tendency and Measures of VariationDocument21 pagesMeasures of Central Tendency and Measures of VariationcindyNo ratings yet

- Publishable FormatDocument9 pagesPublishable FormatRon Santelices100% (1)

- Knowing Oneself - Personal DevelopmentDocument24 pagesKnowing Oneself - Personal Development黄maryNo ratings yet

- Theoritical Foundation in NursingDocument3 pagesTheoritical Foundation in NursingIvy cencie AgawinNo ratings yet

- 10 Items 15 Items 20 Items 25 Items: Transmutation TableDocument2 pages10 Items 15 Items 20 Items 25 Items: Transmutation TableRed Aytona100% (1)

- 4.2 Descriptive Statistics in ExcelDocument26 pages4.2 Descriptive Statistics in ExcelprincessNo ratings yet

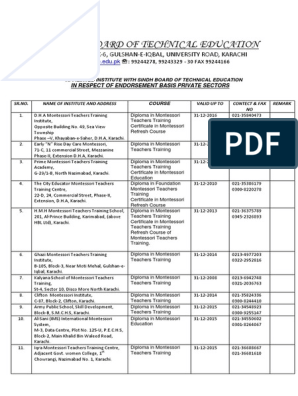

- List of Endorsement BasisDocument12 pagesList of Endorsement Basisalibanker100% (1)

- NSTP LawDocument3 pagesNSTP LawChan ReyNo ratings yet

- Phys 16 21 Module 2 Thermal ExpansionDocument15 pagesPhys 16 21 Module 2 Thermal ExpansionLarkTrebligNo ratings yet

- The Main Characteristics of The Normal Distribution AreDocument4 pagesThe Main Characteristics of The Normal Distribution AreAdriano MatrugeNo ratings yet

- The Fibonacci Sequence: Done By: Ibraheem HammoudehDocument12 pagesThe Fibonacci Sequence: Done By: Ibraheem HammoudehIbrahim HammoudehNo ratings yet

- Ethics AssignmentDocument14 pagesEthics AssignmenthdeuwhyuewNo ratings yet

- ONE-TAILED & TWO-TAILED TESTS ExamplesDocument17 pagesONE-TAILED & TWO-TAILED TESTS ExamplesJulius Fronda0% (1)

- Module 4 - Thermal Physics (Part 1)Document18 pagesModule 4 - Thermal Physics (Part 1)Gabriel Ramos100% (1)

- Reviewer - EntrepDocument14 pagesReviewer - EntrepAngelica JadraqueNo ratings yet

- Biostatistics in RTDocument2 pagesBiostatistics in RTJA KENo ratings yet

- ETHICSDocument4 pagesETHICSJeth Vigilla NangcaNo ratings yet

- Nutrition Functions of ProteinDocument5 pagesNutrition Functions of ProteinvirinowNo ratings yet

- Stocks and BondsDocument1 pageStocks and BondsJeffrey Del Mundo0% (1)

- CHAPTER 1 - Introduction To InvestmentDocument41 pagesCHAPTER 1 - Introduction To InvestmentSuct Wadi100% (1)

- Learning The Language of MathematicsDocument10 pagesLearning The Language of MathematicsM2C7r6No ratings yet

- Lecture 2.1 - Bacteria Vs VirusDocument48 pagesLecture 2.1 - Bacteria Vs VirusNiña Viaña BinayNo ratings yet

- Module 6. Problem SolvingDocument11 pagesModule 6. Problem SolvingAngelica Camille B. AbaoNo ratings yet

- PDFDocument83 pagesPDFTina RetaNo ratings yet

- Nominal, Ordinal, Interval, Ratio Scales With ExamplesDocument9 pagesNominal, Ordinal, Interval, Ratio Scales With ExamplesMd. Tanvir HasanNo ratings yet

- How To Calculate The Weighted MeanDocument11 pagesHow To Calculate The Weighted MeanJessNo ratings yet

- Course Syllabus Numerical MethodsDocument7 pagesCourse Syllabus Numerical Methodstirsollantada100% (1)

- Feedback MechanismDocument18 pagesFeedback MechanismAljon SibayanNo ratings yet

- Module 1 Lesson 1 (With Answers)Document11 pagesModule 1 Lesson 1 (With Answers)LONo ratings yet

- Mathematics in The Modern World ReviewerDocument6 pagesMathematics in The Modern World ReviewerCylle Jerone Buenviaje75% (4)

- Globalization FinalDocument66 pagesGlobalization FinalmagdaashaabanNo ratings yet

- 9 Scientific NotationDocument3 pages9 Scientific NotationMeryl Alyzsa BasaysayNo ratings yet

- Teaching PhilosophyDocument9 pagesTeaching PhilosophyJairo EmarNo ratings yet

- What Is Constructivist Teaching?Document2 pagesWhat Is Constructivist Teaching?Cir Arnold Santos IIINo ratings yet

- 05 Presentation of DataDocument17 pages05 Presentation of DataReinaNo ratings yet

- Handout On LectureDocument5 pagesHandout On LectureRajaNo ratings yet

- Stats Xi All Chapters PptsDocument2,046 pagesStats Xi All Chapters PptsAnadi AgarwalNo ratings yet

- Assesment of Learning 2 SyllabusDocument8 pagesAssesment of Learning 2 SyllabuscheenNo ratings yet

- Obe Nce 311Document12 pagesObe Nce 311Jayson IsidroNo ratings yet

- 2018 Exam Ltam SyllabiDocument7 pages2018 Exam Ltam SyllabiThiruNo ratings yet

- Long-Term Actuarial Mathematics Exam: FALL 2021Document7 pagesLong-Term Actuarial Mathematics Exam: FALL 2021Muchammad adrian FirmansyahNo ratings yet

- Long-Term Actuarial Mathematics Exam: SPRING 2021Document7 pagesLong-Term Actuarial Mathematics Exam: SPRING 2021masayoshi0ogawaNo ratings yet

- Subject CT4 Models Core Technical Syllabus: The Faculty of Actuaries and Institute of ActuariesDocument8 pagesSubject CT4 Models Core Technical Syllabus: The Faculty of Actuaries and Institute of ActuariesgeekeizNo ratings yet

- Karnataka Court Fees and Suits Valuation Act, 1958 PDFDocument102 pagesKarnataka Court Fees and Suits Valuation Act, 1958 PDFLatest Laws TeamNo ratings yet

- Wojtowicz TestimonyDocument1 pageWojtowicz TestimonyWDET 101.9 FMNo ratings yet

- Actuarial MathematicsDocument32 pagesActuarial MathematicsAhsan HabibNo ratings yet

- Lecture - 6 Life InsuranceDocument15 pagesLecture - 6 Life Insurancegyanprakashdeb302No ratings yet

- Customer Perception Towards HDFC Standard LifeDocument78 pagesCustomer Perception Towards HDFC Standard LiferahulmalladiNo ratings yet

- Notice: Employee Benefit Plans Individual Exemptions: PAMCAH-UA Local 675 Pension Plan Et Al.Document5 pagesNotice: Employee Benefit Plans Individual Exemptions: PAMCAH-UA Local 675 Pension Plan Et Al.Justia.comNo ratings yet

- MLC ReviewDocument52 pagesMLC Reviewsxljy8No ratings yet

- Jeevan Saral Plan No 862 Sales BrochureDocument12 pagesJeevan Saral Plan No 862 Sales BrochureSubin PaulNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Manish MishraNo ratings yet

- Credit Transaction ReviewerDocument3 pagesCredit Transaction Reviewermigz_ortaliza100% (1)

- Sept 24 2017Document12 pagesSept 24 2017Anonymous DztSsSNo ratings yet

- Reliance Nippon Life Retire Smart: Complete Retirement PlanningDocument1 pageReliance Nippon Life Retire Smart: Complete Retirement PlanningAchche MitraNo ratings yet

- ULIP Pension PlansDocument5 pagesULIP Pension PlanskammapurathanNo ratings yet

- ICICI Prudential Life Insurance Vs LIC PriDocument53 pagesICICI Prudential Life Insurance Vs LIC PriPriya Aggarwal100% (2)

- The Mathematics of Investment: Research TemplateDocument12 pagesThe Mathematics of Investment: Research TemplateMRX ManNo ratings yet

- MetLife Srinagar SayeemDocument99 pagesMetLife Srinagar Sayeemsayeemlsm100% (1)

- GM 016 344575 PDFDocument15 pagesGM 016 344575 PDFeunha allaybanNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21manishNo ratings yet

- Week 5: Expected Value and Betting SystemsDocument5 pagesWeek 5: Expected Value and Betting Systemsashish barnwalNo ratings yet

- Great American IncomeSustainer Plus BrochureDocument4 pagesGreat American IncomeSustainer Plus BrochureDemetri KravitzNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument9 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRose de DiosNo ratings yet

- Life InsuranceDocument12 pagesLife InsuranceSlim ShadyNo ratings yet

- Steele v. United States of America - Document No. 70Document23 pagesSteele v. United States of America - Document No. 70Justia.com0% (1)

- MTH302 FAQsDocument18 pagesMTH302 FAQsRamesh KumarNo ratings yet

- Taxable Salary IncomeDocument253 pagesTaxable Salary IncomedjbbuzzzNo ratings yet

- Aman VohraDocument116 pagesAman Vohraraman_bhoomi2761No ratings yet

- 1 Lesson 1 Introduction To InsuranceDocument61 pages1 Lesson 1 Introduction To InsurancerachitNo ratings yet

- HDFC ProjectDocument57 pagesHDFC ProjectBhavna SinghalNo ratings yet

- Valuation TableDocument33 pagesValuation TableKiran UgalmugaleNo ratings yet