Crypto Moi

Crypto Moi

Uploaded by

tnumber367Copyright:

Available Formats

Crypto Moi

Crypto Moi

Uploaded by

tnumber367Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Crypto Moi

Crypto Moi

Uploaded by

tnumber367Copyright:

Available Formats

https://www.nerdwallet.

com/article/investing/cryptocurrency

Cryptocurrency Basics: Pros, Cons and How It Works

Cryptocurrencies are supported by a technology known as blockchain, which maintains a tamper-resistant

record of transactions and keeps track of who owns what. The use of blockchains addressed a problem

faced by previous efforts to create purely digital currencies: preventing people from making copies of

their holdings and attempting to spend it twice. Individual units of cryptocurrencies can be referred to as

coins or tokens, depending on how they are used. Some are intended to be units of exchange for goods

and services, others are stores of value, and some can be used to participate in specific software programs

such as games and financial products.

People invest in cryptocurrencies for the same reason anyone invests in anything. They hope its value will

rise, netting them a profit. Bitcoin, once deemed dead or worthless, has experienced a 250% increase in

price since its inception. The surge can be attributed to the SEC's approval of spot Bitcoin ETFs in

January 2024, allowing asset managers to offer exposure to Bitcoin. The 2024 price rise is also influenced

by the "Bitcoin halving" event every four years, which reduces the mining reward from 12.5 to 6.25. The

surge in interest rates in 2022 may have influenced Bitcoin's price, as investors prefer security over

volatility. Some Bitcoin enthusiasts argue that viewing Bitcoin through fiat currencies is misleading, but

the cryptocurrency's volatility is predictable. In the short term, both camps are likely correct, but the

Bitcoin bulls are currently winning.

Cryptocurrencies are created through mining, a complex process used by Bitcoin. Owners receive newly

created tokens as rewards. Other cryptocurrencies use less energy-intensive methods and have lighter

environmental impacts. There are more than two million different cryptocurrencies in existence,

according to CoinMarketCap.com, a market research website [2]. And while some cryptocurrencies have

total market valuations in the hundreds of billions of dollars, others are obscure and essentially worthless.

Some supporters like the fact that cryptocurrency removes central banks from managing the money

supply since over time these banks tend to reduce the value of money via inflation. Some

cryptocurrencies offer their owners the opportunity to earn passive income through a process called

staking. Crypto staking involves using your cryptocurrencies to help verify transactions on a blockchain

protocol. Though staking has its risks, it can allow you to grow your crypto holdings without buying

more.

Many cryptocurrency projects are untested, and blockchain technology in general has yet to gain wide

adoption. If the underlying idea behind cryptocurrency does not reach its potential, long-term investors

may never see the returns they hoped for. Cryptocurrencies face risks for short-term investors, including

rapid price changes, potential loss before a crash, and potential conflicts with the projects they were

created for. The environmental impact of Bitcoin mining is significant, with mining consuming more

power than residential lighting. Additionally, regulatory changes and crackdowns can affect the market in

unpredictable ways, as governments have not yet fully understood how to handle cryptocurrency.

https://www.bankrate.com/investing/how-to-invest-in-cryptocurrency-beginners-guide/

How to start investing in cryptocurrency: A guide for beginners.

Cryptocurrencies are enormously volatile, but that volatility can create opportunities for profit if you’re

looking to trade these digital assets. Cryptos such as Bitcoin and Ethereum have risen a lot since their

debut — but they’ve also experienced tremendous boom-bust cycles along the way.

To invest in cryptocurrencies, it's crucial to understand the investment case for each trade, as many are

backed by nothing, unlike stocks. Popular coins include Ethereum, Dogecoin, Cardano, and Solana.

Before investing, consider the potential upside and downside, as cryptocurrencies may not be backed by

assets or cash flow. The environmental impact of Bitcoin mining is significant, with mining consuming

more power than residential lighting. Some cryptocurrencies use less energy-efficient technology.

Additionally, regulatory changes and crackdowns can affect the market in unpredictable ways. New

investors often make mistakes by looking at the past and extrapolating it to the future. They should focus

on the future and what will drive future returns. Cryptocurrencies are highly volatile, making it difficult

for new investors without the necessary skills or algorithms. Volatility can help sophisticated traders "buy

low and sell high" while inexperienced investors "buy high and sell low. "Managing risk is crucial for

short-term trading, especially with volatile assets like cryptocurrency. Newer traders should develop a

process to mitigate losses and set strict rules on when to sell. Setting aside a portion of trading money and

using it only when needed is essential for maintaining a bankroll. Selling a losing position can help avoid

worse losses later. Lastly, it is essential to avoid investing more than you can afford to lose, especially in

risky assets like cryptocurrency. Keep money in safe accounts and pay off high-interest debt for a

guaranteed return.

Investing in cryptocurrency typically requires a few dollars, with most exchanges having minimum trades

of $5-10. However, some platforms may charge significant fees for small amounts of cryptocurrency, so

it's crucial to find a broker or exchange that minimizes fees. Cryptocurrency mining involves

verifying transactions on blockchain databases, rewarding miners with predetermined Bitcoin

awards for solving complex mathematical problems.

You might also like

- Cryptocurrency for Beginners: Complete Crypto Investing Guide with Everything You Need to Know About Crypto and AltcoinsFrom EverandCryptocurrency for Beginners: Complete Crypto Investing Guide with Everything You Need to Know About Crypto and AltcoinsRating: 4 out of 5 stars4/5 (14)

- John Malone and His Cable Media EmpireDocument58 pagesJohn Malone and His Cable Media EmpireB.C. MoonNo ratings yet

- An Introduction To Crypto: What Is Cryptocurrency?Document12 pagesAn Introduction To Crypto: What Is Cryptocurrency?Sanjay. LNo ratings yet

- All You Need To Know About CryptocurrenciesFrom EverandAll You Need To Know About CryptocurrenciesRating: 4.5 out of 5 stars4.5/5 (6)

- White Paper On Real Estate Investment TrustsDocument9 pagesWhite Paper On Real Estate Investment TrustsSteven HallNo ratings yet

- Suhan 12th Com Eco ProjectDocument31 pagesSuhan 12th Com Eco Projectcharmi3964No ratings yet

- CRYPTO TRADING: Mastering the Art of Cryptocurrency Trading (2024 Guide for Traders)From EverandCRYPTO TRADING: Mastering the Art of Cryptocurrency Trading (2024 Guide for Traders)No ratings yet

- Digital CurrencyDocument2 pagesDigital Currencyshey achiNo ratings yet

- Dangers of Investing in Digital CurrencyDocument4 pagesDangers of Investing in Digital Currencyyasmine.fazeeNo ratings yet

- Cryptocurrency for Absolute Beginners: Learn the Basics & Start Making Money with Crypto TodayFrom EverandCryptocurrency for Absolute Beginners: Learn the Basics & Start Making Money with Crypto TodayNo ratings yet

- New OpenDocument TextDocument6 pagesNew OpenDocument Textalaa hawatmehNo ratings yet

- Guide - How To Invest in CryptocurrencyDocument28 pagesGuide - How To Invest in CryptocurrencyMuli sa EmmanuelNo ratings yet

- Advantages and Disadvantage of CryptocurrencyDocument3 pagesAdvantages and Disadvantage of CryptocurrencySaket BandeNo ratings yet

- Demistifying Crypto 2Document3 pagesDemistifying Crypto 2helloNo ratings yet

- CRYPTO TRADING: A Comprehensive Guide to Mastering Cryptocurrency Trading Strategies (2023)From EverandCRYPTO TRADING: A Comprehensive Guide to Mastering Cryptocurrency Trading Strategies (2023)No ratings yet

- Crypto AgainstDocument3 pagesCrypto AgainstRonan WeislyNo ratings yet

- Fib Assignment SolutionsDocument15 pagesFib Assignment SolutionsMusangabu EarnestNo ratings yet

- The Rise of Cryptocurrency - Benefits, Challenges, and AdoptionDocument8 pagesThe Rise of Cryptocurrency - Benefits, Challenges, and AdoptionMarcos LalorNo ratings yet

- WordDocument18 pagesWordaga.webflowNo ratings yet

- Importance of Cryptocurrency PDFDocument6 pagesImportance of Cryptocurrency PDFMayar WalidNo ratings yet

- BITCOIN OPTIONS & MARGIN TRADING TIPS USING TRADING BOTS: Maximizing Profits and Minimizing Risks in Bitcoin Options and Margin Trading with Automated Bots (2024)From EverandBITCOIN OPTIONS & MARGIN TRADING TIPS USING TRADING BOTS: Maximizing Profits and Minimizing Risks in Bitcoin Options and Margin Trading with Automated Bots (2024)No ratings yet

- Top Ten Risks For The Crypto-Currency Investor: A View From The Cayman IslandsDocument5 pagesTop Ten Risks For The Crypto-Currency Investor: A View From The Cayman IslandsAria Imam AmbaraNo ratings yet

- Cryptocurrencies and Initial Coin Offerings (ICOs) - ACCA GlobalDocument8 pagesCryptocurrencies and Initial Coin Offerings (ICOs) - ACCA GlobalaisyahNo ratings yet

- What Is Cryptocurrency?: Definition and Examples CryptocurrencyDocument4 pagesWhat Is Cryptocurrency?: Definition and Examples CryptocurrencyHeidar Usmael JundiNo ratings yet

- Cryptocurrencies Have Been Gaining Popularity Over The Last DecadeDocument3 pagesCryptocurrencies Have Been Gaining Popularity Over The Last DecadeFadhly HafizNo ratings yet

- CryptoDocument5 pagesCryptoBucio, KhayeNo ratings yet

- Only Cryptocurrency Can Save Your Money NowDocument4 pagesOnly Cryptocurrency Can Save Your Money NowTimileyin AdigunNo ratings yet

- Cryptocurrency Rotaru GeorgeDocument22 pagesCryptocurrency Rotaru GeorgeGeorge Cristinel RotaruNo ratings yet

- Bitcoin and Cryptocurrency Trading for Beginners I Must Have Guide to Start Achieving Your Financial Freedom Today I Tools, Wallets, Analysis, Charts, Best Exchanges, Tips and Strategies, DisciplineFrom EverandBitcoin and Cryptocurrency Trading for Beginners I Must Have Guide to Start Achieving Your Financial Freedom Today I Tools, Wallets, Analysis, Charts, Best Exchanges, Tips and Strategies, DisciplineNo ratings yet

- Crypto Passive Income StrategyDocument4 pagesCrypto Passive Income StrategyMelvin Masengo ValNo ratings yet

- Final Assignment - Crypto 23Document9 pagesFinal Assignment - Crypto 23Vinessen SevatheanNo ratings yet

- Crypto Trading For Beginners: A Step-by-Step Guide to Making Consistent Money from Crypto TradingFrom EverandCrypto Trading For Beginners: A Step-by-Step Guide to Making Consistent Money from Crypto TradingRating: 5 out of 5 stars5/5 (1)

- العملات الافتراضية - تقارير بنك التوسيات الدولى BISDocument6 pagesالعملات الافتراضية - تقارير بنك التوسيات الدولى BISWael HassanNo ratings yet

- Short Note of CT 1 2Document3 pagesShort Note of CT 1 2SanjidaNo ratings yet

- What Is Cryptocurrency - Forbes AdvisorDocument12 pagesWhat Is Cryptocurrency - Forbes Advisorhabeeb_matrixNo ratings yet

- Professor Abdulrazaq Alaro, Head Department of Islamic Law, University of Ilorin, Kwara StateDocument15 pagesProfessor Abdulrazaq Alaro, Head Department of Islamic Law, University of Ilorin, Kwara Statenurhairin nizanNo ratings yet

- Demistifying CryptoDocument1 pageDemistifying CryptohelloNo ratings yet

- Crypto Lending PDFDocument7 pagesCrypto Lending PDFMadison GraceNo ratings yet

- Research Paper On CryptocurrencyDocument4 pagesResearch Paper On Cryptocurrencygzrvpcvnd100% (1)

- ResearchDocument13 pagesResearchrasheedbaji288No ratings yet

- Project Business LAWDocument33 pagesProject Business LAWMahmoud ZeinNo ratings yet

- Beyond the Hype: Navigating the Risks and Rewards of Cryptocurrencies: Cryptocurrency Deep Dive, #1From EverandBeyond the Hype: Navigating the Risks and Rewards of Cryptocurrencies: Cryptocurrency Deep Dive, #1No ratings yet

- I SwastikYadav 153 CryptocurrencyDocument5 pagesI SwastikYadav 153 CryptocurrencySwastik YadavNo ratings yet

- Cryptocurrency PDFDocument7 pagesCryptocurrency PDFRanjani AnandNo ratings yet

- Crypto CurrencyDocument6 pagesCrypto CurrencySanchali GoraiNo ratings yet

- CRYPTOCURRENCYDocument3 pagesCRYPTOCURRENCYKim PaoNo ratings yet

- Cryptocurrency All You Need to Know Before You InvestFrom EverandCryptocurrency All You Need to Know Before You InvestNo ratings yet

- Vikash Crypto CurrencyDocument6 pagesVikash Crypto Currencysonuk06212No ratings yet

- PCL Research Paper Sem 3Document14 pagesPCL Research Paper Sem 3Mridula SwaminathanNo ratings yet

- Cryptocurrency Trading & Investment Guide for Bulls: 2 in 1 Blockchain & Bitcoin Revolution. How to DeFi and Make Money in Decentralized Finance. Learn Bitcoin and Ethereum and Altcoins.From EverandCryptocurrency Trading & Investment Guide for Bulls: 2 in 1 Blockchain & Bitcoin Revolution. How to DeFi and Make Money in Decentralized Finance. Learn Bitcoin and Ethereum and Altcoins.No ratings yet

- Cryptocurrecies: Why It Is The Future of MoneyDocument7 pagesCryptocurrecies: Why It Is The Future of MoneyMyra ChoyyNo ratings yet

- Advantages and Disadvantages of CryptocurrencyDocument4 pagesAdvantages and Disadvantages of CryptocurrencyMaira HussainNo ratings yet

- This Study Resource Was: Blades Inc. Chapter 7Document6 pagesThis Study Resource Was: Blades Inc. Chapter 7rizwan aliNo ratings yet

- Porsche: The Cayenne Launch: Anirban Mohanty - Aniruddha Deshpande - Himanshu Shekher - Jayram Palnitkar - Parul JainDocument6 pagesPorsche: The Cayenne Launch: Anirban Mohanty - Aniruddha Deshpande - Himanshu Shekher - Jayram Palnitkar - Parul JainParul JainNo ratings yet

- Who Pays Report PDFDocument139 pagesWho Pays Report PDFChris JosephNo ratings yet

- Chapter 01 - Combinatorial AnalysisDocument23 pagesChapter 01 - Combinatorial AnalysisBatu GünNo ratings yet

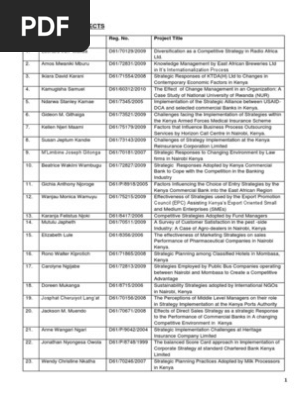

- 2011 - 2012 Alumni List - Mba - University of Nairobi - Timothy MaheaDocument40 pages2011 - 2012 Alumni List - Mba - University of Nairobi - Timothy MaheaMaheaNo ratings yet

- Vision and Scope Document TemplateDocument6 pagesVision and Scope Document TemplatetugaPezNo ratings yet

- Financial Accounting Assignment: JbimsDocument9 pagesFinancial Accounting Assignment: JbimsNikhil KasatNo ratings yet

- McDonald's Data and Arby's DataDocument23 pagesMcDonald's Data and Arby's DataRahil VermaNo ratings yet

- Financial RatiosDocument15 pagesFinancial RatiosKeith Joshua GabiasonNo ratings yet

- R and D Portfolio DecisionDocument67 pagesR and D Portfolio DecisionManthila AmarasenaNo ratings yet

- Presented By: Group 5: - : Ritika Mandal (24) Sunayana Paikray (25) Ranjita Sahu (26) Arpita Mishra (27) Shahbaz KhanDocument16 pagesPresented By: Group 5: - : Ritika Mandal (24) Sunayana Paikray (25) Ranjita Sahu (26) Arpita Mishra (27) Shahbaz KhanSahabazKhanNo ratings yet

- Eun 10e International Financial Management PPT CH05 AccessibleDocument43 pagesEun 10e International Financial Management PPT CH05 AccessibleMaciel García FuentesNo ratings yet

- Relationship of Finance With Other BranchesDocument2 pagesRelationship of Finance With Other BranchesxunaidNo ratings yet

- (9781785360503 - Handbook of Finance and Development) Financial Development and Innovation-Led GrowthDocument28 pages(9781785360503 - Handbook of Finance and Development) Financial Development and Innovation-Led GrowthEkoa Akono marie BéréniceNo ratings yet

- Bank Advisers Fleece Clients - News - IOL - Breaking News - South Africa News - World News - Sport - Business - Entertainment - 000000000000557Document3 pagesBank Advisers Fleece Clients - News - IOL - Breaking News - South Africa News - World News - Sport - Business - Entertainment - 000000000000557SCRUPEUSSNo ratings yet

- Revenue Recognition: Sale of Goods and Services (AS-9) and Construction Contracts (AS-7)Document31 pagesRevenue Recognition: Sale of Goods and Services (AS-9) and Construction Contracts (AS-7)Aayushi AroraNo ratings yet

- Montenegro MapDocument220 pagesMontenegro MapStephan PüschelNo ratings yet

- Functions of Financial MarketDocument3 pagesFunctions of Financial MarketPooja TripathiNo ratings yet

- SecuritizationDocument39 pagesSecuritizationSakshi GuravNo ratings yet

- Are Profit Maximizers Wealth CreatorsDocument36 pagesAre Profit Maximizers Wealth Creatorskanika5985No ratings yet

- Trading Futures Successfully From The Shoulders of Giants, Futures Truth - 4, 2013.Document7 pagesTrading Futures Successfully From The Shoulders of Giants, Futures Truth - 4, 2013.fernandoh50% (2)

- AFAR QuestionsDocument6 pagesAFAR QuestionsTerence Jeff TamondongNo ratings yet

- National Investment Vs AquinoDocument6 pagesNational Investment Vs AquinokerovreportingNo ratings yet

- Officer Handbook Final EditionDocument87 pagesOfficer Handbook Final EditionJohn SmithNo ratings yet

- CANDEVCO Flyers - New OfficeDocument2 pagesCANDEVCO Flyers - New OfficeCANDEVCO DaetNo ratings yet

- Pharmaceutical Industry of Bangladesh: BUS 690: Strategic ManagementDocument16 pagesPharmaceutical Industry of Bangladesh: BUS 690: Strategic Managementhaque666No ratings yet

- Pridel Investments Pty LTD - Company InformationDocument4 pagesPridel Investments Pty LTD - Company InformationclarencegirlNo ratings yet

- Assignment 2Document14 pagesAssignment 2DrShailesh Singh ThakurNo ratings yet