Irr(1)

- 1. Topics Covered Competitors to NPV The Payback Period The Book Rate of Return Internal Rate of Return ALSO Consider Capital Rationing

- 2. Payback The payback period of a project is the number of years it takes before the cumulative forecasted cash flow equals the initial outlay. The payback rule says only accept projects that “payback” in the desired time frame. This method is very flawed, primarily because it ignores later year cash flows and the the present value of future cash flows.

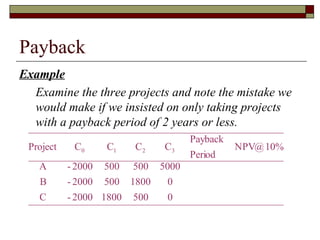

- 3. Payback Example Examine the three projects and note the mistake we would make if we insisted on only taking projects with a payback period of 2 years or less. Payback Project C0 C1 C2 C3 NPV@ 10% Period A - 2000 500 500 5000 B - 2000 500 1800 0 C - 2000 1800 500 0

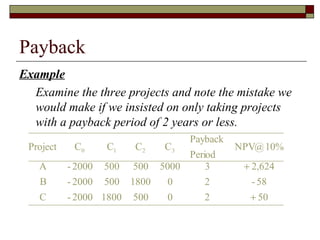

- 4. Payback Example Examine the three projects and note the mistake we would make if we insisted on only taking projects with a payback period of 2 years or less. Payback Project C0 C1 C2 C3 NPV@ 10% Period A - 2000 500 500 5000 3 + 2,624 B - 2000 500 1800 0 2 - 58 C - 2000 1800 500 0 2 + 50

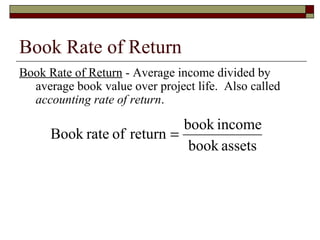

- 5. Book Rate of Return Book Rate of Return - Average income divided by average book value over project life. Also called accounting rate of return. book income Book rate of return = book assets

- 6. The book rate of return It does recognise that capital is required to earn income. However it has shortcomings as an investment appraisal method It does not have a hurdle rate It does not recognise the time value of money Ambiguity regarding its definition.

- 7. The Internal Rate of Return Like the NPV this is a discounted cash flow criterion. In the single period case where we are merely interested in accepting or rejecting a project it is exactly equivalent to the NPV rule. However in all other situations congruence of the IRR and NPV rules cannot be guaranteed. When a conflict does occur the NPV gives the correct answers.

- 8. Definition of IRR The IRR is the discount rate that when used to discount a projects cash flow gives an NPV of zero.

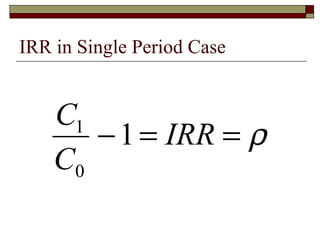

- 9. IRR in Single Period Case C1 − 1 = IRR = ρ C0

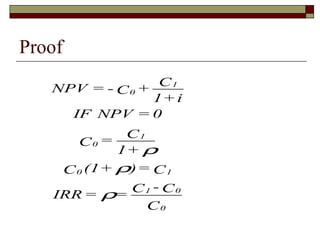

- 10. Proof C1 NPV = - C 0 + 1+ i IF NPV = 0 C1 C0 = 1+ ρ C 0 (1 + ρ) = C 1 C1 - C0 IRR = ρ= C0

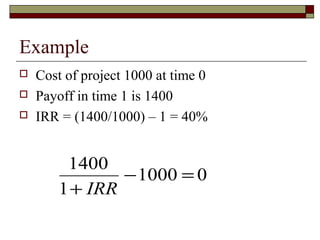

- 11. Example Cost of project 1000 at time 0 Payoff in time 1 is 1400 IRR = (1400/1000) – 1 = 40% 1400 − 1000 = 0 1 + IRR

- 12. IRR Decision Rule Accept all projects with a rate of return that is greater than the cost of capital.

- 13. IRR versus NPV For accept/reject decisions in a single period case the NPV and IRR decision rules give exactly the same answer. For ranking decisions conflicts may occur

- 14. Structure of Analysis Single Period Case Accept / Reject Decisions Ranking Decisions Multi-period Case Accept / Reject Decisions Ranking Decisions

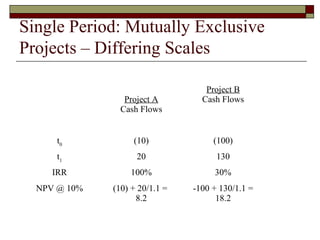

- 15. Single Period: Mutually Exclusive Projects – Differing Scales Project B Project A Cash Flows Cash Flows t0 (10) (100) t1 20 130 IRR 100% 30% NPV @ 10% (10) + 20/1.1 = -100 + 130/1.1 = 8.2 18.2

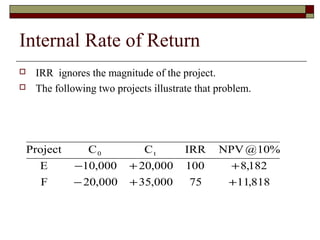

- 16. Internal Rate of Return IRR ignores the magnitude of the project. The following two projects illustrate that problem. Project C0 Ct IRR NPV @ 10% E −10,000 + 20,000 100 + 8,182 F − 20,000 + 35,000 75 +11,818

- 17. IRR in Multi-period Case The IRR generally gives the same answer in accept/reject decisions. However, there may be some technical difficulties with the IRR. First we will examine how to compute the IRR in the multiperiod case.

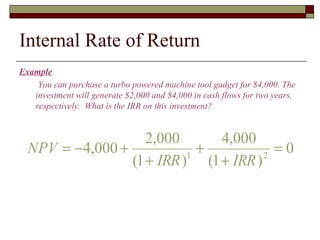

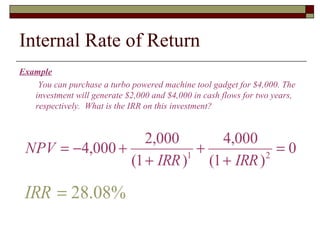

- 18. Internal Rate of Return Example You can purchase a turbo powered machine tool gadget for $4,000. The investment will generate $2,000 and $4,000 in cash flows for two years, respectively. What is the IRR on this investment?

- 19. Internal Rate of Return Example You can purchase a turbo powered machine tool gadget for $4,000. The investment will generate $2,000 and $4,000 in cash flows for two years, respectively. What is the IRR on this investment? 2,000 4,000 NPV = −4,000 + + =0 (1 + IRR ) (1 + IRR ) 1 2

- 20. Internal Rate of Return Example You can purchase a turbo powered machine tool gadget for $4,000. The investment will generate $2,000 and $4,000 in cash flows for two years, respectively. What is the IRR on this investment? 2,000 4,000 NPV = −4,000 + + =0 (1 + IRR ) (1 + IRR ) 1 2 IRR = 28.08%

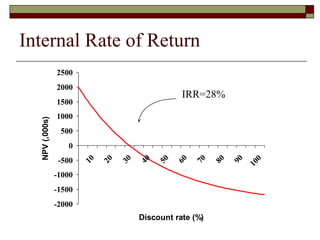

- 21. Internal Rate of Return 2500 2000 IRR=28% 1500 1000 NPV (,000s) 500 0 -500 20 60 10 30 40 50 70 80 90 0 10 -1000 -1500 -2000 Discount rate (%)

- 22. IRR computation with Excel ® See IRRDR.xls

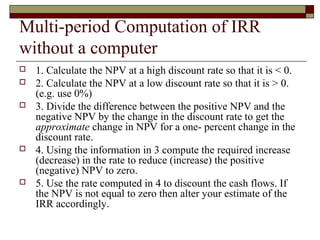

- 23. Multi-period Computation of IRR without a computer 1. Calculate the NPV at a high discount rate so that it is < 0. 2. Calculate the NPV at a low discount rate so that it is > 0. (e.g. use 0%) 3. Divide the difference between the positive NPV and the negative NPV by the change in the discount rate to get the approximate change in NPV for a one- percent change in the discount rate. 4. Using the information in 3 compute the required increase (decrease) in the rate to reduce (increase) the positive (negative) NPV to zero. 5. Use the rate computed in 4 to discount the cash flows. If the NPV is not equal to zero then alter your estimate of the IRR accordingly.

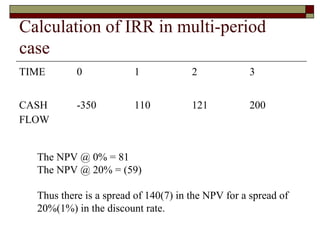

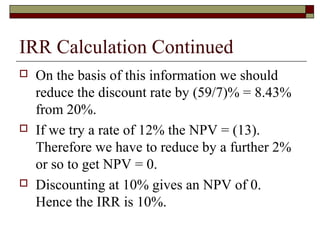

- 24. Calculation of IRR in multi-period case TIME 0 1 2 3 CASH -350 110 121 200 FLOW The NPV @ 0% = 81 The NPV @ 20% = (59) Thus there is a spread of 140(7) in the NPV for a spread of 20%(1%) in the discount rate.

- 25. IRR Calculation Continued On the basis of this information we should reduce the discount rate by (59/7)% = 8.43% from 20%. If we try a rate of 12% the NPV = (13). Therefore we have to reduce by a further 2% or so to get NPV = 0. Discounting at 10% gives an NPV of 0. Hence the IRR is 10%.

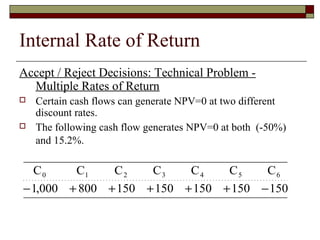

- 26. Internal Rate of Return Accept / Reject Decisions: Technical Problem - Multiple Rates of Return Certain cash flows can generate NPV=0 at two different discount rates. The following cash flow generates NPV=0 at both (-50%) and 15.2%. C0 C1 C2 C3 C4 C5 C6 − 1,000 + 800 + 150 + 150 + 150 + 150 − 150

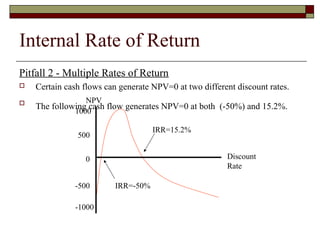

- 27. Internal Rate of Return Pitfall 2 - Multiple Rates of Return Certain cash flows can generate NPV=0 at two different discount rates. NPV The following cash flow generates NPV=0 at both (-50%) and 15.2%. 1000 IRR=15.2% 500 0 Discount Rate -500 IRR=-50% -1000

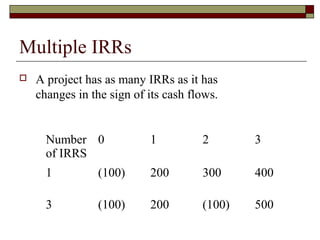

- 28. Multiple IRRs A project has as many IRRs as it has changes in the sign of its cash flows. Number 0 1 2 3 of IRRS 1 (100) 200 300 400 3 (100) 200 (100) 500

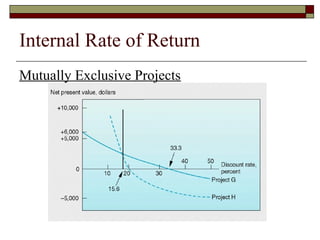

- 29. Internal Rate of Return Mutually Exclusive Projects

- 30. Internal Rate of Return Reinvestment rate assumption There is an implicit assumption that all intermediate cash inflows are reinvested at the IRR It makes far more sense to assume that the intermediate cash flows are reinvested at the opportunity cost of capital. We assume that discount rates are stable during the term of the project.

- 31. Profitability Index Profitability Index is PV/C0 The rule is to accept all projects which have a PI > 1. One gets the same answers as the NPV for accept/reject decisions. For ranking decisions conflicts arise in a manner similar to the IRR case e.g. differences in the scale of the project.

- 32. The Profitability Index and Capital Rationing There is one case where the Profitability Index is superior to the NPV. This is where the firm faces a limit on the amount it can invest in a single year and projects are divisible and there is no postponement. In this special case one should maximise the NPV per £1 invested.

- 33. Profitability Index When resources are limited, the profitability index (PI) provides a tool for selecting among various project combinations and alternatives A set of limited resources and projects can yield various combinations.

- 34. Project appraisal: capital rationing, •Coping with investment appraisal in an environment of capital rationing, taxation and inflation •More specifically: – Explain why capital rationing exists and be able to use the profitability ratio in one-period rationing situations

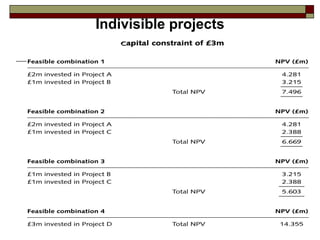

- 35. Capital rationing •Capital rationing occurs when funds are not available to finance all wealth-enhancing projects •Soft rationing •Hard rationing •One-period capital rationing – 1 Divisible projects – 2 Indivisible projects

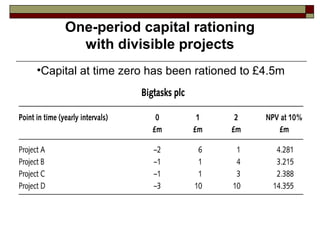

- 36. One-period capital rationing with divisible projects •Capital at time zero has been rationed to £4.5m

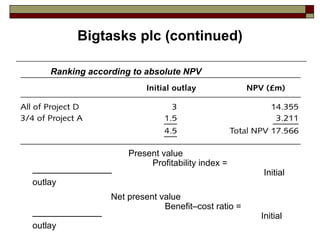

- 37. Bigtasks plc (continued) Ranking according to absolute NPV Present value Profitability index = –––––––––––––––– Initial outlay Net present value Benefit–cost ratio = –––––––––––––– Initial outlay

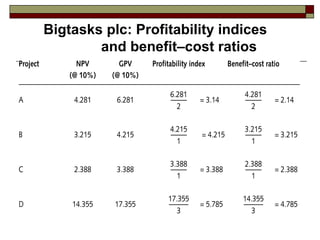

- 38. Bigtasks plc: Profitability indices and benefit–cost ratios

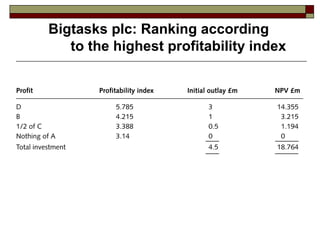

- 39. Bigtasks plc: Ranking according to the highest profitability index

- 41. NPV – the pros NPV is the theoretically correct criteria for making investment decisions when maximisation of shareholder wealth is the objective It recognises the time value of money It forces managers to consider their projections carefully when estimating future cash flows

- 42. NPV – the pros continued It is generally easy to use It has a clear decision rule It can deal with multiple discount rates – unlike IRR It is not affected by differences in scale – unlike IRR and Profitability Index

- 43. NPV – the cons It does not help find value creating projects It does not lend itself to ex-post evaluation of managers in a straightforward manner. But residual income can help here.

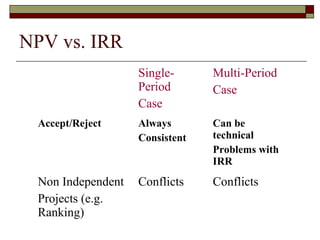

- 44. NPV vs. IRR Single- Multi-Period Period Case Case Accept/Reject Always Can be Consistent technical Problems with IRR Non Independent Conflicts Conflicts Projects (e.g. Ranking)

- 45. IRR – the pros It is theoretically correct for accept/reject decsions It recognises the time value of money

- 46. IRR – the cons It cannot be relied upon to signal the correct decision for non-independent projects – e.g. mutually exclusive projects of differing scales. Can have multiple IRRs Some projects have no IRR The re-investment assumptions of the rule do not make economic sense

- 47. IRR – the cons continued It cannot cope with multiple discount rates In addition it has all the other the drawbacks of the NPV criterion.